The strength of STIEL lies in developing and implementing a strategy with the right guidance in executing activities. Tenacity and adaptive entrepreneurship can be learned.

During the establishment and development of the specialized recycling company Purified Metal Company (PMC), all conceivable aspects of starting a business are addressed. The three initiators of PMC, including STIEL, design an innovative process that not only safely and circularly processes asbestos-contaminated steel but also other pollutants in conjunction with steel. Throughout the subsequent journey, various feasibility studies are conducted to validate this concept. The process, spanning several years, involves thorough assessment of economic, technical, and legal feasibility. Partners are sought, and the idea is deemed feasible on all fronts. Actual funding is secured, and the realization of PMC becomes a reality. The underlying reason for this is a robust business case linked to an equally thorough risk analysis.

Key starting point: creating the business case

For the production of steel, scrap is used. However, this scrap often contains a quantity of asbestos (or other toxic substances) that cannot be adequately removed. Normally, this scrap would be dumped at designated landfill sites. Various scientific sources indicate that all types of asbestos are destroyed and converted into harmless components within seconds above a certain temperature (present in a steel furnace of a steel plant). Based on this information, STIEL and two other initiators with a background in the steel industry devise an innovative idea to destroy the asbestos and recycle the steel by melting it in a steel bath at over 1,500°C. The technologies come from various sectors, including the asbestos industry, the scrap industry, the steel industry, and foundries. This results in a process where 100% contaminated steel is received and 99% clean steel is produced as raw material for steel plants and foundries. This innovation is patented worldwide.

With the patent in hand, entrepreneurship begins. On the way to realizing the recycling plant for heavily contaminated steel scrap, we are confronted with numerous crucial questions. What does the market for contaminated steel look like? Is there enough material available? What are the financial prospects of our plan? Can we find suitable suppliers for both the construction and installation of the plant? To answer these questions, we conduct careful analyses. Finding potential buyers is relatively easy when the end product is sustainable. By melting scrap, we can achieve significant CO₂ reduction, attracting subsidies and investors. We develop a sales strategy and create detailed financial models. All stakeholders, such as processors of the recycled material, are involved to mitigate risks.

Among potential risks, we investigate the release of asbestos fibers and associated health risks. We also examine technological feasibility, for example by demonstrating that asbestos fibers break down at a required temperature of 1,100°C. We assess whether there is demand for the recycled material, analyze market size, and identify key players in the industry. Moreover, we ensure that there is enough material available to make the recycling process economically viable, determining availability and consistency.

A sound business case includes comprehensive risk analysis

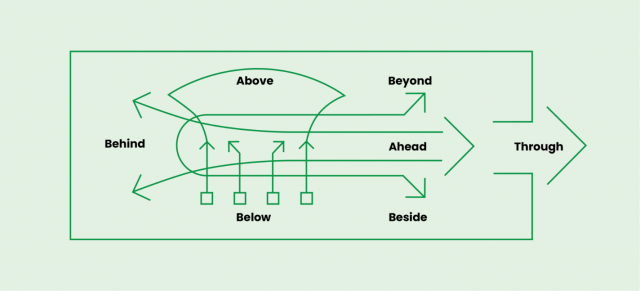

Before we can actually present a so-called ‘bankable’ business case to banks and potential investors, we first need to work out all the risks. And suppliers need to be found for the construction of the factory and the associated installations. When we are on the verge of finalizing a joint venture with one of the largest suppliers of steel plants on paper, they back out at the last moment. We venture into the market with new insights to see if we can purchase components separately from different suppliers or find a so-called ‘system integrator’. This turns out to be feasible and results in a turnkey contract with a construction company and supplier of the innovative process. STIEL and team members set to work on developing the entire process, from rough sketch to detailed engineering. In this, we delve into three specific focus areas per team member: the legal and financial aspects, market analysis, and all technical and environmental permit aspects.

Additionally, we face the challenge of finding a suitable location in the Netherlands for ‘heavy industry’. After careful consideration of a large number of possible locations, including Amsterdam, Rotterdam, Delfzijl, Arnhem, and Coevorden, Groningen is chosen due to favorable location conditions, good cooperation with local stakeholders, and available subsidies. We secure a plot of land at the chemical park in Farmsum and sign letters of intent with market parties. The risk of obtaining environmental and construction permits is crucial, and we have therefore obtained these at an early stage of the process, even before the financing is finalized.